Famous & 65 – Alzheimer’s – Optimum Senior Care – Chicago In Home Care – www.OptimumSeniorCare.com

Look Who Is Turning 65

View the celebrities turning 65 in January 2018.

Look Who’s Turning 65

January 1 – Gary Johnson

Gary Johnson ran for president of the United States on the Libertarian ticket in 2012 and again in 2016. He was the Republican Governor of New Mexico from 1995 to 2003, running on a low-tax, anti-crime platform. True to his word, he cut annual 10% growth in the state’s budget partly by using the gubernatorial veto 200 times in his first six months in office.

Johnson founded one of New Mexico’s largest construction companies. It began while he was in college, and helped pay for classes by going door-to-door as a handyman. Big J Enterprises started in 1976 with Johnson as the only employee.

When growth of the company began to explode, Johnson took a time management course in night school to cope. Before he sold the company in 1999, Big J had become a multimillion-dollar company with more than 1,000 employees.

After the 2016 presidential race, Johnson declared he would not run for public office again.

January 10 – Pat Benatar

Pat Benatar dominated the airwaves in the 1980s with hits like “We Belong”, “Love Is a Battlefield”, and “Hit Me with Your Best Shot”. She’s a four-time Grammy Award winner with 15 Billboard Top 40 singles and five platinum albums.

Benatar sang her first solo at age eight in an elementary school performance. She grew up in the Long Island village of Lindenhurst. Benatar married her high school sweetheart, Dennis Benatar, at age 19. Born Patricia Mae Andrzejewski, it’s no surprise the singer kept her first husband’s last name after their divorce years later.

The singer had plans to attend the Juilliard School, but opted for the state university instead. Benatar worked as a bank teller while her first husband was stationed in Fort Lee, Virginia with the Army. But she quit her job in 1971 after getting inspiration from a Liza Minnelli concert, starting as a singing waitress, then got a gig singing in the lounge band Coxon’s Army.

Benatar slowly rose up the ladder, performing at amateur nights and singing at Catch a Rising Star when she moved back to New York after her husband was discharged. She was becoming famous when she divorced in 1978 after signing with Chrysalis Records. Benatar is currently remarried with two children.

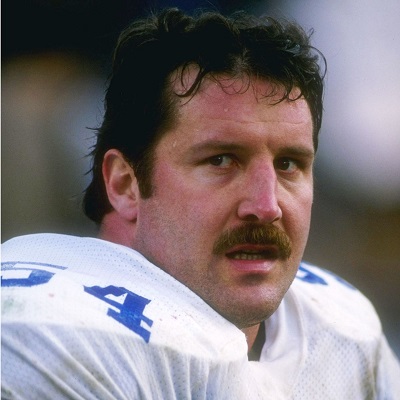

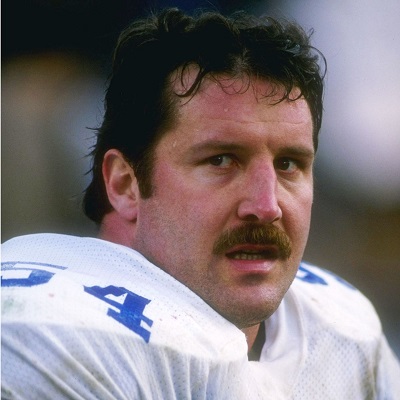

January 15 – Randy White

Randy White played defensive tackle for the Dallas Cowboys from 1975 to 1988, earning a spot in the Pro Football Hall of Fame. His career began at Thomas McKean High School. Playing defensive end and linebacker, White is still considered the “Best All-Time Player” in the history of Delaware high school football.

White went to the University of Maryland and played fullback his freshman year, where he did nothing to stand out on a team that finished with only two wins. But the next year, new head coach Jerry Claiborne moved him to defensive end. It was a brilliant fit, and by his senior year White won the Outland Trophy, Lombardi Award, and Atlantic Coast Conference Player of the Year, as well as Most Valuable Player in the team’s loss to Tennessee at the Liberty Bowl. In 1994, White was elected to the College Football Hall of Fame.

White was the second draft in the first round in 1975, spending his entire career with the Dallas Cowboys. He played middle linebacker, and then found his fit as a defensive tackle. The year he turned 25, he was named to his first All-Pro team, his first Pro Bowl and was named co-MVP of Super Bowl XII with teammate Harvey Martin, one of only ten defensive players ever to be awarded that honor. White earned the nickname “The Manster”(half man, half monster).

White was the second draft in the first round in 1975, spending his entire career with the Dallas Cowboys. He played middle linebacker, and then found his fit as a defensive tackle. The year he turned 25, he was named to his first All-Pro team, his first Pro Bowl and was named co-MVP of Super Bowl XII with teammate Harvey Martin, one of only ten defensive players ever to be awarded that honor. White earned the nickname “The Manster”(half man, half monster).

January 19 – Desi Arnaz Jr.

The birth of Desi Arnaz Jr. was the most publicized on T.V. in 1953. He’s the son of Desi Arnaz and Lucille Ball, whose show I Love Lucy featured the pregnancy as part of the storyline. Arnaz Jr. (as “Little Ricky”) and his sister Lucie appeared in the show as the character’s children from 1968 to 1974.

Arnaz Jr. was a drummer in a band at age 12 with Dean Martin’s son and Billy Hinsche. They had two hits: “I’m a Fool” and “Not the Lovin’ Kind”. He continued acting and had many roles in movies and television into the 1980s. In 1992, he had a starring role playing his father in The Mambo Kings, based on a Pulitzer Prize-winning novel.

From 1998 to 2010, Arnaz Jr. toured with a new iteration of his old band, performing original work and new material.

Now a billionaire, Newmark is still active in Craigslist customer service, outing spammers and scammers. He’s also a devoted philanthropist, operating Craigconnects to publish charitable organizations. Newmark has a special interest in services for military veterans and teachers.

Arnaz Jr. has a daughter from an undisclosed relationship. He was married to Linda Purl, an actress, for a year in the early 80s. In 1987 he married Amy Laura Bargiel. They lived in Boulder City, Nevada, where they owned the Boulder Theatre. Bargiel died from cancer in 2015 at the age of 63.

January 28 – Debbie Steinbach

Steinbach hit the professional tour in 1975 after attending California State University at Fullerton. Her best finish was a T-5 in the Florida Lady Citrus. She’s had a lasting impact as an instructor, teaching more than 5,000 individual lessons and earning a “Top 50” from Golf for Women magazine.

She’s a founder and CEO of Venus Golf clinic for women, and authored Venus on the Fairway, a book that highlights the different learning styles of men and women on the fairway. Her broadcasting experience extends from local radio shows in California near La Quinta to color commentary during national coverage for sports shows on NBC and ESPN.

http://www.optimumseniorcare.com/services/alzheimerscare.php

http://optimumseniorcare.com/blog/

https://www.facebook.com/OptimumseniorcareIL